GM offloads Lordstown Motors stake, at a loss

General Motors has sold its stake in Lordstown Motors, further exacerbating the nosedive in the electric vehicle startup’s share price.

GM acquired 7.5 million shares in Lordstown, or less than 5%, when the company went public via a SPAC deal back in 2020, paying $75 million made up in cash and proceeds from the sale of an Ohio plant to Lordstown in 2019.

A spokesman for GM told Bloomberg in an interview published on Tuesday that the shares were sold during the course of the fourth quarter of 2021, suggesting the maximum GM could have received would be $60 million and the lowest $26 million, based on Lordstown’s share price during the period. At the time of writing Lordstown’s share price was $2.29, down from a high of $29.01 reached shortly after the company went public.

GM almost entered a similar deal with rival EV startup Nikola in 2020, though scaled the deal back after allegations of fraud at Nikola started to surface.

Lordstown during an earnings call on Monday said it lost $81.2 million, or $0.42 per share, in the fourth quarter. The company’s goal is to put into production an electric pickup truck called the Endurance. It is hopeful of building the first 500 examples in 2022, though will need to raise $250 million to do so.

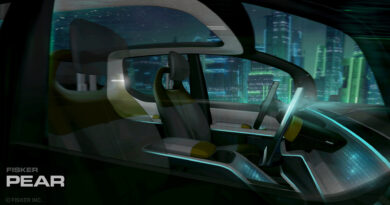

Lordstown doesn’t plan to build the trucks itself, as it no longer owns the plant it bought from GM. The plant was sold to contract manufacturer Foxconn in 2021 in a deal that will see Foxconn build the Endurance for Lordstown. Foxconn will also use the plant to build a vehicle code-named Project Pear for Fisker.

Source : Autonews.com